- #Business credit score check how to#

- #Business credit score check full#

- #Business credit score check plus#

#Business credit score check plus#

Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.The three major credit-reporting bureaus - Dun & Bradstreet, Experian, and Equifax - collect information about how promptly your company pays its bills, plus lots of other financial data, and compiles it all in a credit report. UpCounsel accepts only the top 5 percent of lawyers to its site.

#Business credit score check how to#

If you need help with how to check your EIN credit, you can post your legal need on UpCounsel's marketplace. This report provides a credit score, a credit summary, an analysis of your company's payment trends, and a listing of public records, such as bankruptcies, liens, or judgments.

This score predicts the likelihood of your business being delinquent with repayment within the next year. Experian: Often used by lenders when considering your business for loans or lines of credit.This score reflects the timeliness of your company's bill payment history. Dun and Bradstreet: Often used by vendors and suppliers to evaluate trading terms with your business.The primary credit agencies that businesses use for credit reports are: Your business should periodically monitor its credit score and make any updates or corrections as needed. If you discover that not many of these businesses are reporting your good credit, consider opening accounts with companies that do report your business's good credit to reporting agencies. This lets you know which business credit reports you need to monitor. Contact any businesses that your company has credit with and ask where they report that your company has made its payments on time.

#Business credit score check full#

As another option, you can use your EIN to apply for a small business loan, which you should repay in full prior to the due date. Alternatively, you can use your EIN to apply for a small business loan, which you should repay in full prior to the due date. Make any necessary purchases and repay the amount in full prior to the due date. Build your company's credit scores by using your EIN to apply for a business credit card.Use your EIN when applying for credit trade accounts with your vendors and pay the amount in full prior to the due date.

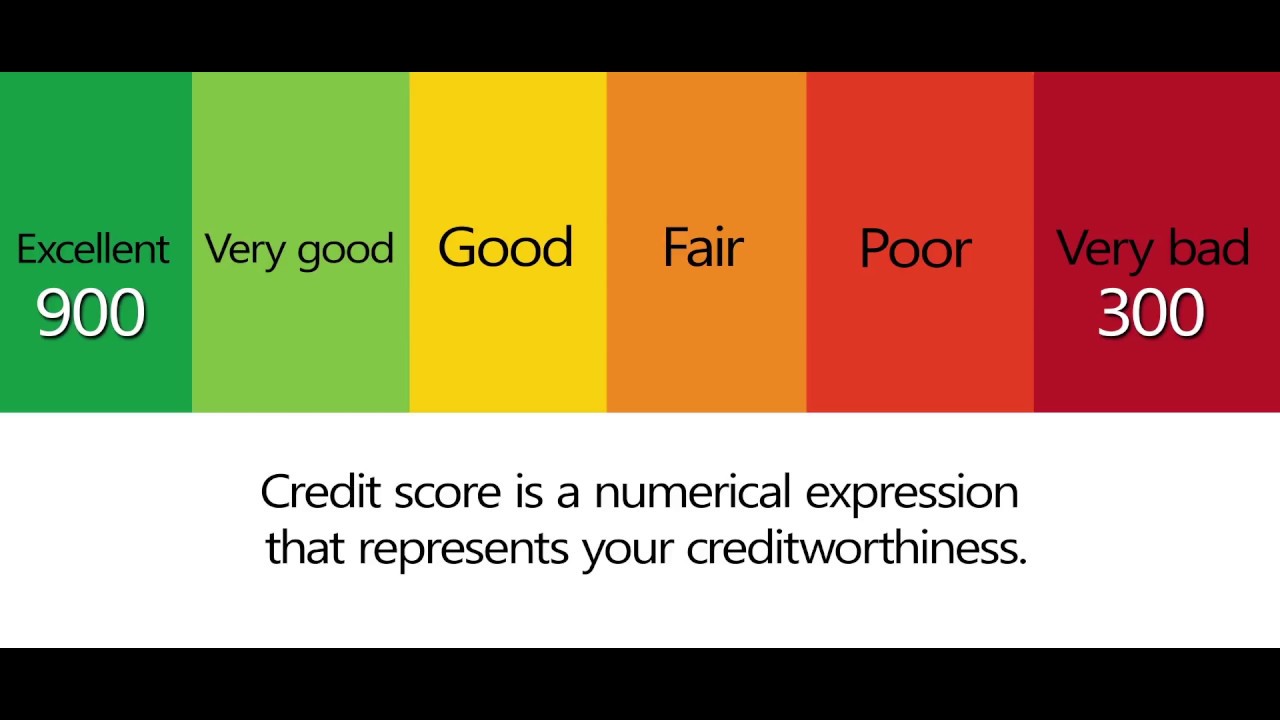

Pay vendors and suppliers in a timely manner.Structuring your business as an LLC or corporation will help separate your personal credit from your business credit. As a result, any missteps in your personal credit could damage your company's credit score. As a sole proprietor, your personal financial information is combined with your business's financial information.Once your company obtains a DUNS number, the following are some suggestions that will help your business establish a good credit score: Any alternate names your company uses (“doing business as” names).This number is issued by the credit bureau, Dun & Bradstreet. To establish business credit using an EIN, your business must apply for a DUNS number. Debt payment history, including outstanding debts.How Are Business Credit Scores Calculated?īusiness credit scores are calculated based on your company's financial history, such as: Good credit scores also help your business qualify for lower rates on business insurance and some loan options. In addition to lenders, business credit scores tell your vendors and suppliers how likely you are to pay them for the products or the services they provide your business. These reports help them determine the likelihood that your business will pay them back the money they lend to you. Because your business's credit score reflects your history of paying bills on time, banks and other lenders will use credit reports to consider approving your business for a loan or for another financing. Like personal credit scores, businesses also have scores that show their creditworthiness to lenders. Like an individual's social security number, this nine-digit number helps the IRS identify and track payments to businesses with employees, including: What Is an Employer ID Number?Īn EIN is one type of tax ID the Internal Revenue Service issues to businesses. Like a personal credit score, your business credit score reflects the likelihood of your company providing timely payments on its debts. Checking your Employer Identification Number (EIN) credit provides you with insight into your business's creditworthiness.

0 kommentar(er)

0 kommentar(er)